What is your business doing right? Where are pain points that have room for improvement? How satisfied are your employees? What do your customers think about your brand?

Market Research

Product Update: MaxDiff Analysis Now Available Within CheckMarket

With MaxDiff, you can now better understand consumer preferences across various use cases. Whether your objective is to prioritize product features or to get clarity on how different messages resonate with the market, MaxDiff is a precise and proven method for extracting exactly what’s important for your audience.

5 Easy Tips for Increasing Online Survey Response Rates

How to Discover Hidden Gems in Your Data Using Factor & Cluster Analysis

You know that feeling when you already looked at your data from all angles? You separated it based on gender, age, socioeconomic status and even location, but you still think there is more to discover? Factor and cluster analysis help you discover patterns in your dataset that go beyond simply splitting it up according to demographics, and in this blogpost we will explain how to best use both of them.

6 Ways to Make Employees Fill in Your Surveys

Employee surveys are key tools for any business. They can measure the mood in a company, allow employees to give input and see how an employer is doing on certain issues.

To make employee surveys work, however, you need a sufficient amount of employees filling them in. Having high degrees of non-response can cause your survey to be less reliable and can cause biases to arise.

How Startups like Airbnb Measure Customer Satisfaction

“The ability to learn faster from customers is the essential competitive advantage that startups must possess”, wrote Eric Ries in his book The Lean Startup, the unofficial bible of the startup movement. Measuring customer feedback is extremely important to startups, and in this blogpost we will show you how three of them (TransferWise, Uber and Airbnb) do it.

What are my GDPR Responsibilities for Surveys?

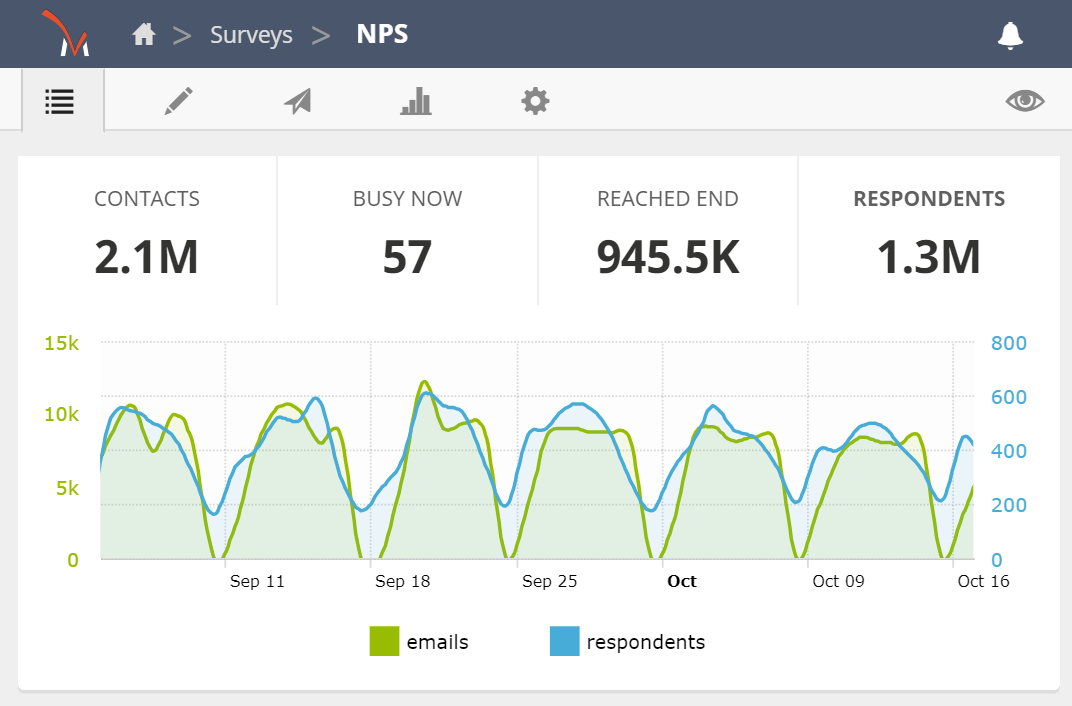

Survey Contacts Simplified!

Surveys have changed a lot in the last fifteen years. For instance, customer satisfaction has gone from a long once-a-year survey to short continuous longitudinal surveys spread across the customer journey. CheckMarket has evolved too, introducing new features and best practices along the way.

Why buying NPS benchmarks is a bad idea

It’s about using an NPS system to improve your own internal processes and become a more customer centric organization.

In app surveys, finally learn who your users are

App builders often do not know a lot about their users. They have all kinds of behavioral data, such as how often the app is opened, how long the user spends, …

But they don’t have demographics (age, gender, …) and very little feedback about the user’s experiences or grievances. It is possible to conduct a survey in app, without sending their user away to the browser.

Internal customer satisfaction: how to use surveys to measure and improve internal processes

Measuring customer satisfaction? Ask the right questions!

If you want to gain an insight into your customer satisfaction level, a survey is what your need. But which questions do you absolutely need to ask in order to effectively measure such a vague concept as customer satisfaction? There are roughly 4 categories of questions that will help you effectively measure customer satisfaction: customer loyalty, overall satisfaction, perceived attribution of quality and intentions to repurchase. Let’s have a closer look at these customer satisfaction survey questions.

5 online surveys advantages that will convince your boss to start market research

“Surveys are expensive, time-consuming and they lead to nothing.” Sounds familiar? Then your boss needs some convincing before you can finally conduct your own online survey. Luckily, we have just what you need. Here are 5 great unexpected online surveys advantages your superior probably never saw coming.

Measure customer satisfaction: CSAT, CES and NPS compared

4 tips to get everyone involved in your Net Promoter Score Program: Webinar

As we all know, just measuring Net Promoter ScoreSM is not enough. The true goal of an Net Promoter Score program is to raise customer satisfaction which requires getting everyone in your organization involved. Just because the upper echelons of management decide that NPS is important, doesn’t automatically make it so for everybody.

Today, we give you 4 concrete tips you can apply immediately.

4 stages of Net Promoter Score (NPS)

Net Promoter Score (NPS): Advanced Workflow Webinar

Alexander quickly touched on the basics of Net Promoter Score explaining why NPS® is gaining more and more popularity. He shared some insights into the calculation of NPS. These insights showed the best improvement techniques such as: what group (detractors, passives, promoters) should you focus on to improve your NPS score, how can you involve everybody in your organization and how does the power of the customer influence the Net Promoter Score.

Pitfalls of “don’t know/no opinion” answer options in surveys

In this new blog article we dig deeper into the use of the “don’t know” and “no opinion” (“DK/NO”) answer options in closed questions. After all, there is some debate in the scientific literature on whether to include or omit them. After extensively discussing the pros and cons of adding/omitting these answer options, we will provide you with some recommendations on how to deal with these answer options.

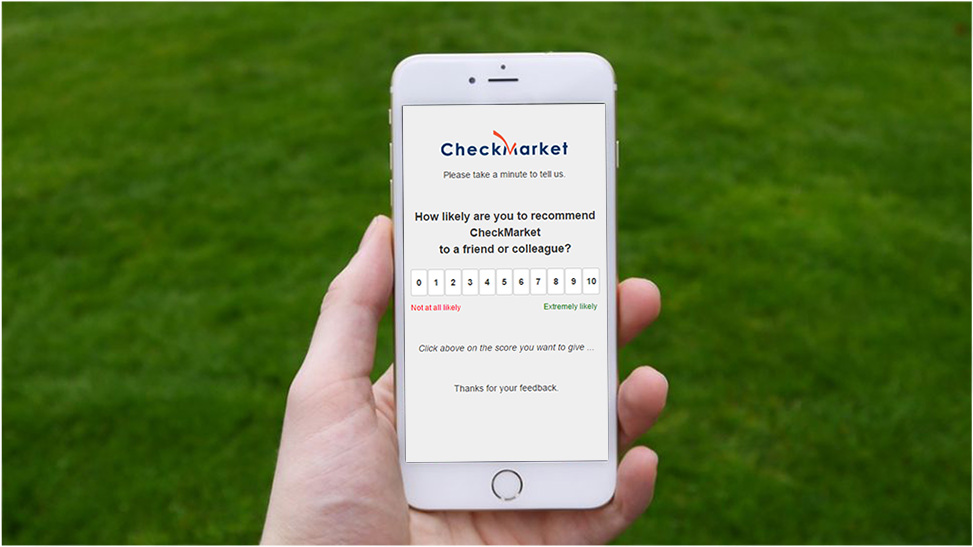

Don’t ignore 19% of your survey respondents

According to a study from Greenbook[1] with over 1.5 million participants a whopping 19% of all online surveys are taken on a mobile device. CheckMarket’s data confirms 1 out of 5 respondents needs a mobile-friendly surveys.

Net Promoter Score (NPS) – Everything you need to know in 14 slides.

We often receive questions from our visitors and customers about Net Promoter ScoreSM (NPS®). Our NPS article was already viewed more than 50,000 times. We decided to make it even easier to understand Net Promoter Score (NPS) by making a clear presentation explaining all the basics of NPS in 14 slides.

How to deal with sensitive topics in a survey?

Suppose you are the Employee Satisfaction Manager at a European multinational and you would like to conduct an employee satisfaction survey. More precisely, as you have heavily invested into an equal opportunities policy in the past year, you would like to find out if your investment is starting to pay off. In other words, if there are any differences in satisfaction between socio-demographic minority and majority groups. As a result, in order to be able to study this, you have to identify your minority groups. Consequently you have to ask your respondents/employees about some potentially sensitive topics such as sexual orientation, religious beliefs, … In other situations, subjects such as political preferences, income, various attitudes and behaviours, etc. are also considered to be sensitive issues.

How to determine population and survey sample size?

Discover CheckMarket’s research services

CheckMarket is especially known for its powerful and user-friendly web-based survey tool, as you have been using it in large numbers. Nonetheless, it is less known that we also provide many of our customers with complex analyses and presentations of the research findings. This is something we would like to change. After all, CheckMarket also wants to be your partner concerning more advanced analyses.

Likert Scales vs. Slider Scales in commercial market research

The Likert Scale – in its various formats – is widely used, for instance in psychology, social sciences but also in commercial market research. Respondents may be asked about their attitudes, perceptions or evaluations of organisations, services or brands. The use of Likert Scales, however, has come under scrutiny. It is argued that the traditional 5-point rating scales are boring, repetitive and overly long. The proposed alternative is the Slider Scale. The question then is this: are Slider Scales really better than Likert Scales?

Manage the follow-up of dissatisfied respondents

In this day and age of social media, where unhappy customers tell the world about their bad customer experience with a click, it is imperative to quickly and efficiently handle complaints and negative responses from surveys.

When we introduced real-time alerts in 2011, we had no idea how popular it would become. Now, a lot of best practice has surfaced and one of these is how to manage, track and report the follow-up of alerts.

Let’s take a look at a structured follow-up method, using CheckMarket’s platform itself.

3 market research trends from The Hague

Early February the Marketing & Information Event (MIE) 2012 took place in The Hague.

During these two days, inspiring speakers and workshops gave an overview of the latest trends and developments in the field of market research.

The 2300 visitors had more than 90 workshops to choose from. CheckMarket was there too. For those of you who did not attend the event itself, we would like to share what we have learned. We selected three trends.

Survey-reviews.net calls us a powerful online tool

Survey-reviews.net is a website that reviews professional sites that offer survey platforms to help users create their own surveys, collect responses and analyse results.

They tested the CheckMarket tool and consider it a “a very powerful online survey software that falls into the enterprise survey software category.”

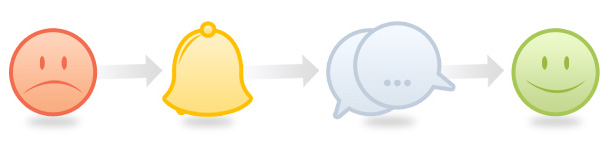

Automated alerts: Listen – Act – Win

Surveys can seem like rather one-way communication to respondents. They give their time and effort to complete a survey and too often don’t receive any feedback about their answers.

Automated alerts give you the opportunity to break that perception and quickly interact with your respondents. Alerts, used correctly, can win back at-risk customers. They allow you to communicate with dissatisfied customers to learn and repair damaged relationships through coordinated follow-up.

For example, you can identify disappointed customers automatically based on an NPS® or general satisfaction question and push an email alert to their account manager for immediate follow-up.